Furthermore, the liquidation price may move if any changes occur to maintenance margin rate. Margin amount alteredįurthermore, the liquidation price may move if you alter your position by either adding or removing margin, increasing or decreasing your position size. Binance doesn’t make any money off of these funding fees. The funding rate helps maintain the balance between the futures market price and the spot market price. It is either added to or subtracted from the wallet balance, changing the liquidation price.įunding rates are payments exchanged between users on each side of a contract (long vs. The funding rate is usually a small percentage of the position size but can be larger in times of volatility. Taking into account the formula of liquidation, the Margin Balance may also be impacted if there is a change in the Wallet Balance. The liquidation price may also change due to funding rate. While the Cross Margin Mode allows you to share the risk over all your positions, it’s usually harder to manage and puts all your wallet funds at risk. When the Margin Ratio reaches 100%, it means that some of your positions may be liquidated as the wallet balance is lower than the Maintenance Margin. In Cross Margin Mode, traders can avoid liquidation by watching the Margin Ratio closely. It’s the margin balance allocated to an individual position.įollow the steps in the image below to switch Cross and Isolated Margin Mode on the Binance mobile application.įollow the steps in the image below to switch Cross and Isolated Margin Mode on Binance Desktop. Whereas in Isolated Margin Mode, the liquidation price remains unchanged.

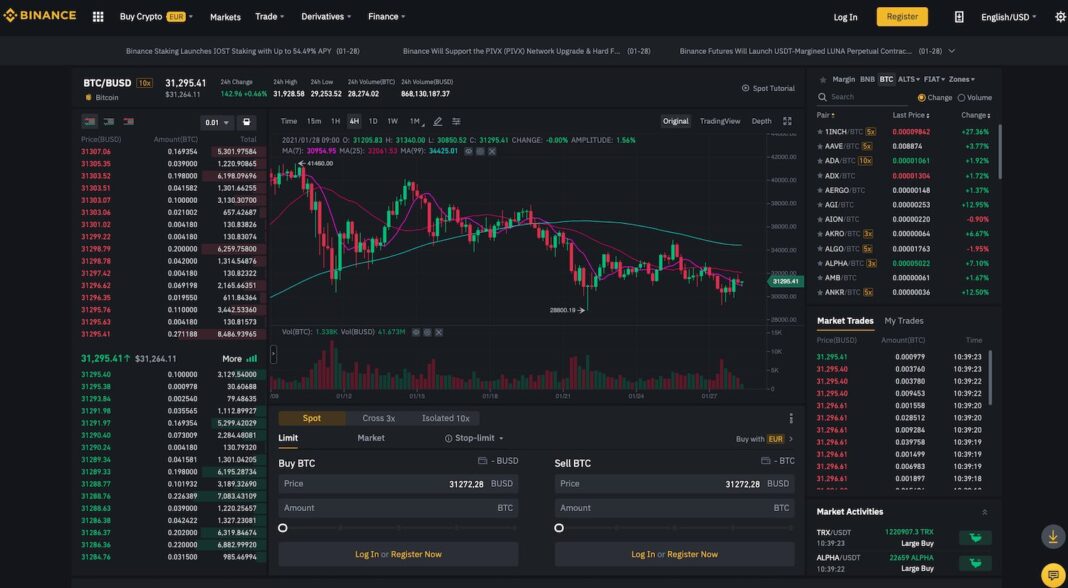

Therefore, the liquidation price will constantly move according to the performance of those positions. Taking into consideration the formula above, by sharing your Margin balance across multiple open positions in Cross Margin Mode, the unrealized PnL will affect the Margin Balance. Margin Balance = Wallet balance + Unrealized PnL For better understanding, let’s revise the fundamental principle of the liquidation protocol, which is: If you hold more than one position, the liquidation price constantly changes in accordance with the performance of your positions. In Cross Margin Mode, the entire margin balance is shared across all open positions. As these differences are usually missed in the futures market, users often find that their liquidation price has changed or the stop-loss order did not protect their position from getting liquidated. Isolatedįutures liquidation price behaves differently between the Cross and Isolated Margin Mode. However, there are some exceptions to this scenario, considering the dynamics of the liquidation protocol. Strictly speaking, the liquidation price of a position remains unchanged. Users with a short position must follow if the contract’s Mark Price does not reach above its liquidation price or else they will lose the margin.įollow the steps in the image below to switch from Last Price to Mark Price and vice versa on the Binance mobile app.įollow the steps of the image below to switch from Last Price to Mark Price and vice versa if you are using the Desktop version. Users with a long position must notice if the contract’s Mark Price does not reach below its liquidation price or else the position will be liquidated.

If they were to occur at Last Price, even a minor volatility event on Binance would result in unnecessary liquidations even though the underlying asset is yet to reach the liquidation price. Liquidation at Mark Price avoids spikes and combats market manipulation. Users should take note of the gap between Mark Price and Last Price as liquidation always occurs at Mark Price. The Last Price refers to the latest trade price of a contract, and Mark Price is the estimated fair value of a contract. While trading on Binance Futures, you may have come across two different types of prices: Last Price and Mark Price. This article tackles three common misconceptions about liquidations. These circumstances are often misunderstood while trading cryptocurrency futures. In order to protect yourself against losses, it’s important to understand the occurrences under which your position is likely to be liquidated. While it’s an attractive feature, it can also expose users to liquidation risks. Liquidation price behaves differently under Cross Margin Mode and Isolated Margin Mode.īinance Futures allow users to trade with leverage whereby you can open positions by funding an initial margin. While trading on Binance Futures, liquidation always occurs at Mark Price and not Last Price. Understanding the circumstances under which a position is likely to be liquidated aids users in equipping them with better risk management strategies.

0 kommentar(er)

0 kommentar(er)